Source: Cointelegraph

Investors must have assets under management exceeding $1.1 million or a net worth over $2.2 million to qualify for Grayscale’s Dynamic Income Fund.

Grayscale Investments has announced an investment fund tailored to sophisticated clients eager to expose their portfolios to income generated from staking cryptocurrency tokens.

According to a recent statement, the Grayscale Dynamic Income Fund is only available to clients with more than $1.1 million assets under management or a net worth of more than $2.2 million.

The fund intends to convert staking rewards into United States dollars weekly, with distributions planned quarterly for investors. Additionally, Grayscale claims that careful analysis will be conducted to select the proof-of-stake (PoS) tokens included in the fund’s portfolio.

“Grayscale manages the complexity of staking and unstaking multiple tokens as each token has its own individual timelines and requirements to be staked and unstaked.”

The main priority of the fund is to maximize staking income from the assets, with capital growth as a secondary focus, according to Grayscale.

Crypto staking involves locking up crypto tokens to earn interest or rewards, which in turn ensures the secure and efficient operation of the blockchain network.

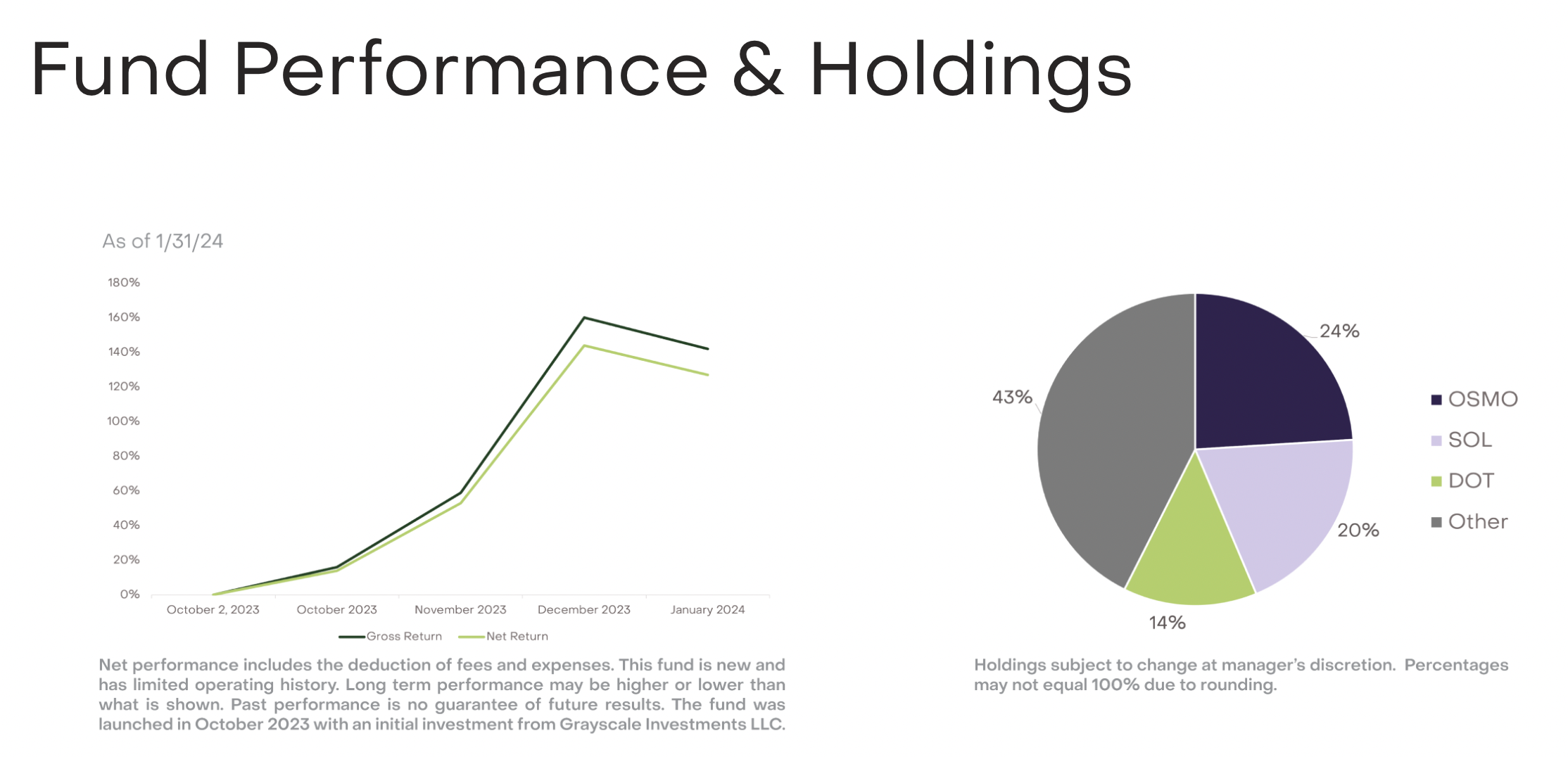

Grayscale has named three PoS tokens that will be held in the fund: Osmosis (OSMO) has a 24% share, Solana has 20%, and Polkadot has 14%, while 43% is categorized under other tokens.

OSMO currently offers a staking reward rate of 11.09%, SOL offers 7.42%, and DOT is at 11.9%, according to data from Staking Rewards.

However, only SOL ranks among the top 10 PoS tokens by market capitalization, as per CoinMarketCap data.

Meanwhile, Grayscale’s spot Bitcoin exchange-traded fund (ETF), which launched on Jan. 11, has seen billions of outflows.

On March 26, Cointelegraph reported that the Grayscale Bitcoin Trust has seen daily outflows totaling over $14 billion since its launch.

Grayscale’s Bitcoin ETF charges a 1.5% per year management fee, five times that of the 0.30% average of other spot Bitcoin ETFs.

Grayscale has applied for an Ethereum Futures ETF, but the United States Securities and Exchange Commission recently delayed a decision on whether to approve the product.