Source: Cointelegraph

A US appeals court said Treasury’s OFAC “overstepped” when it sanctioned Tornado Cash’s immutable smart contracts, leading to a nearly 900% surge in TORN.

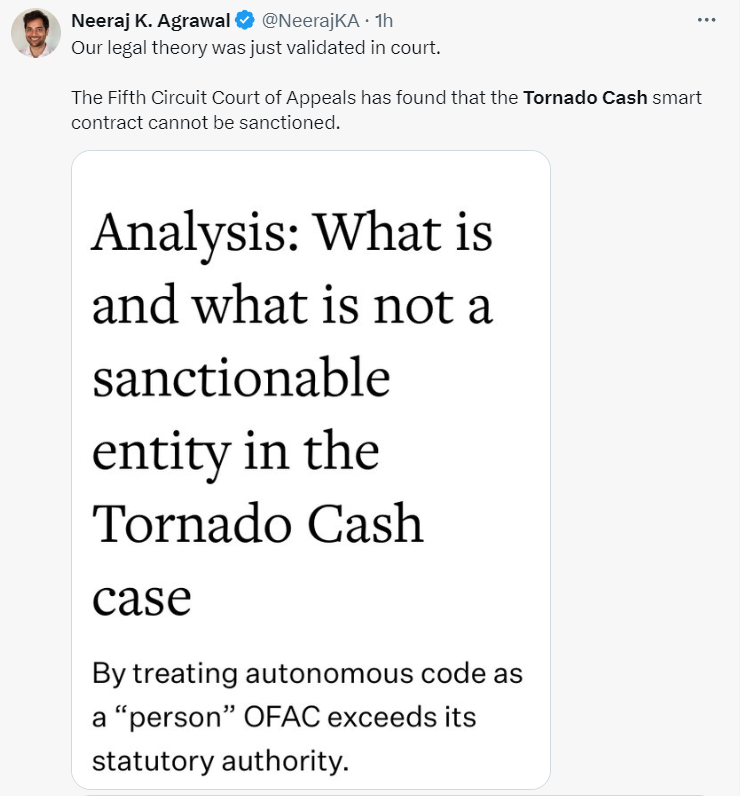

Tornado Cash users have scored a major victory in a United States appeals court after a three-judge panel found the Treasury’s sanctions against the crypto mixer’s immutable smart contracts were unlawful.

In a Nov. 26 legal opinion, a Fifth Circuit Appeals Court’s three-judge panel said the Office of Foreign Assets Control (OFAC) exceeded its authority in sanctioning Tornado Cash’s immutable smart contracts — reversing a lower court’s decision and granting the platform’s users a partial summary judgment.

The appeals court panel said that while the Treasury has the power to take action against property, Tornado Cash’s immutable smart contracts were not property under the International Emergency Economic Powers Act (IEEPA) as they can not be controlled or owned.

“We hold that Tornado Cash’s immutable smart contracts (the lines of privacy-enabling software code) are not the “property” of a foreign national or entity, meaning (1) they cannot be blocked under IEEPA, and (2) OFAC overstepped its congressionally defined authority.”

The IEEPA is a United States federal law enacted in 1977, giving the President authority to regulate and prohibit certain financial transactions.

“In sum, they cannot be blocked under federal law,” Bill Hughes, a lawyer at Consensys, summarized on X. “They certainly can’t be blocked as an exercise of OFAC’s discretion.”

However, Hughes noted that this does not mean Tornado Cash is in the clear.

“This does NOT mean that the rest of Tornado Cash is out of bounds for Treasury/OFAC too. The issue was about smart contracts with no admin key.”

The US Treasury sanctioned Tornado Cash in August 2022, alleging at the time that it had been used to launder more than $7 billion worth of crypto since its creation in 2019.

Weeks later, six Tornado Cash users led by Joseph Van Loon, with the support of Coinbase, sued the Treasury, arguing that its addition of 44 Tornado Cash smart contract addresses to the Specially Designated Nationals (SDN) list was “not in accordance with law.”

Crypto advocacy group Coin Center followed with its own suit in October.

But almost a year later, a Texas federal court judge sided with the US Treasury, ruling that Tornado Cash was “an entity that may be designated per OFAC regulations.”

The plaintiffs appealed this decision, eventually leading to the most recent judgment on Nov. 26.

“These smart contracts must now be removed from the sanctions list and US persons will once again be allowed to use this privacy-protecting protocol.”

Tornado Cash (TORN) surged as much as 866% after the news broke, reaching a two-year high of $34.98.