Source: Cointelegraph

This Swiss fintech aims to modernize banking infrastructure by using Web3 technology: ERC-721 NFTs for client IDs and ERC-20 tokens for deposits.

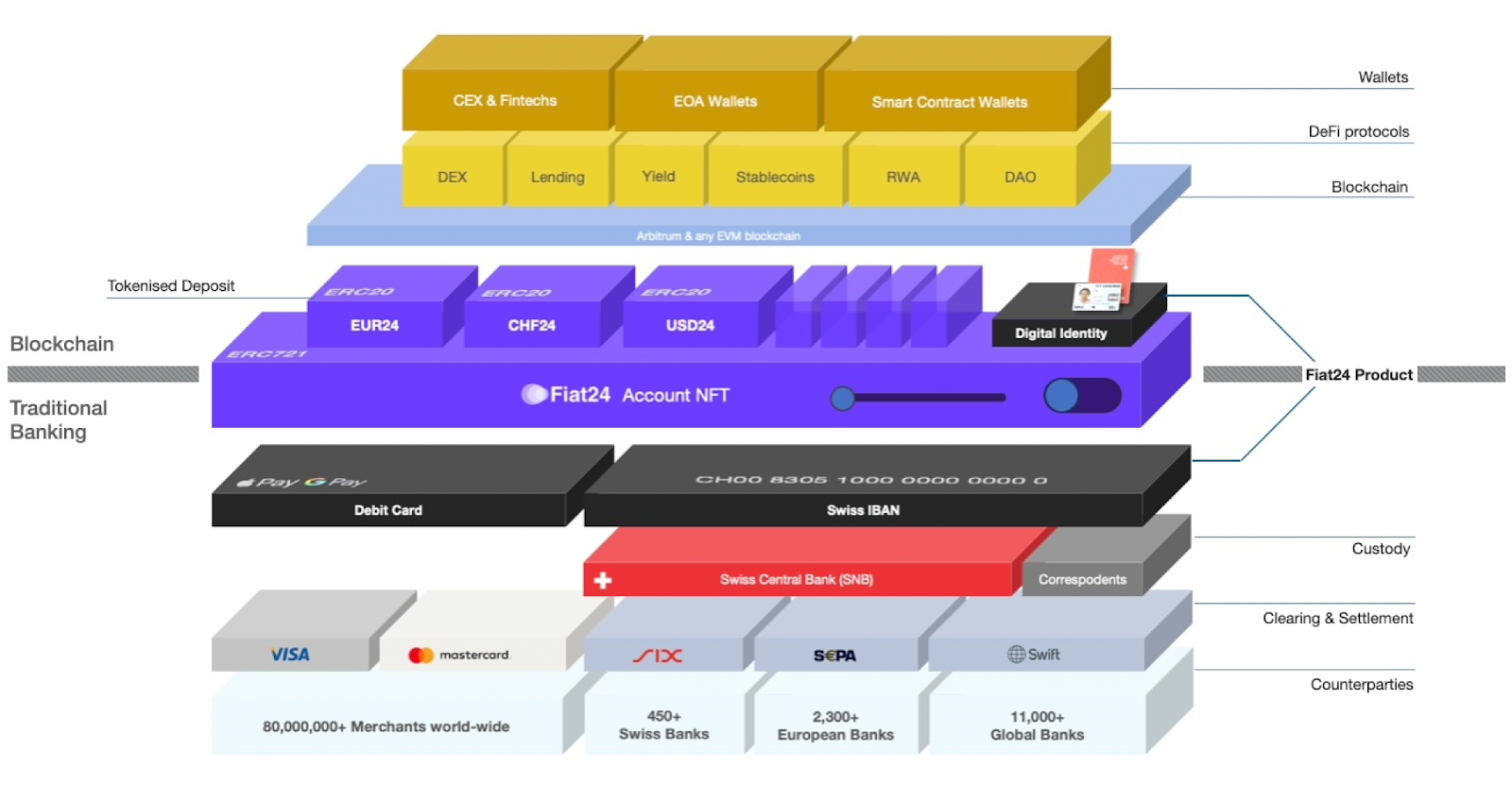

Swiss fintech Fiat24 is rebuilding banking infrastructure using Web3 technology, utilizing ERC-721 to represent clients’ on-chain IDs and ERC-20 for deposits.

From the early days of online banking and the digital age, the challenge of earning user trust and confidence in utilizing new technologies with which to bank and access their accounts has been arduous. As paper and physical processes of documenting client ledgers transitioned to fully online, server-based ones, it took time for people to grow accustomed to using apps rather than pen and paper.

In the emerging stage of the Web3 era, the acceptance of a nonfungible token (NFT) to replace the current form of e-banking will take time. Yet, a Swiss fintech company, Fiat24, is rebuilding banking infrastructure in a purely Web3 manner, utilizing ERC-721 to represent clients’ on-chain IDs and ERC-20 to represent their deposits.

ERC-721: NFTs are more than simple pictures

NFTs have come a long way from their initial hype in the market as apes, penguins and kitties. They have the power to help people reimagine everything from real estate to experiences to ticketing.

As smart contracts — self-executing digital agreements — gradually replace centralized computer programs, the role of NFTs becomes increasingly important because smart contracts can directly interact with the parameters stored in NFT metadata, enabling them to provide different services to different NFT holders.

For Fiat24, the NFTs are used to represent client identities, making it possible for the platform to know who is who in their ecosystem. However, more than just acting as digital identities, the NFT also serves as legal proof of ownership for the client, proving that they are the account holder.

It is also the access key to the account, as holding the NFT in the connected wallet allows the client to effectively log in to their account. And finally, the NFT also holds all the logic necessary for performing banking activities.

Opening a Swiss IBAN account for the client, with the last few digits of the account corresponding to the NFT number, Fiat24 offers features beyond those of a typical Swiss bank account.

ERC-20: An efficient payment network

Customer account balances are represented using ERC-20 tokens, and all operational logic is executed through smart contracts. This allows customers to directly manage their online banking in their preferred noncustodial wallets such as MetaMask and seamlessly convert their digital assets into fiat currency.

The “atomic swap” feature of blockchain technology enables seamless exchanges between two assets simultaneously without relying on centralized intermediaries. In comparison to traditional payment networks like SWIFT and SEPA, ERC-20 tokens has the potential for better efficiency and accuracy, enabling faster and more precise transfers.

The programmability of ERC-20 tokens allows automated financial processes like conditional payments and lending, eliminating the need for intermediaries like banks. Furthermore, the decentralized nature of blockchain eliminates central authorities, increasing transaction speed and reducing costs. These features position ERC-20 tokens as an optimal solution for cross-border and peer-to-peer transactions.

The power of combining ERC-721 and ERC-20

By leveraging NFTs for on-chain identity verification and storing transaction parameters while using ERC-20 as a booking ledger, smart contracts are able to combine both in order to replicate all banking functions. Switzerland-based Fiat24 project aims to rebuild banking structures using Web3 technology.

Fiat24 has connected with traditional payment networks like SWIFT, SEPA, Visa and Mastercard, synchronizing payment information through ERC-20 tokens directly onto the blockchain.

Banking in Web3: Swiss IBAN NFTs

Owning a Fiat24 NFT offers numerous benefits. The NFT itself represents a Swiss international bank account number (IBAN). Once Know Your Customer (KYC) verification is complete, this IBAN functions like any European bank account. However, it stands out because you can seamlessly convert digital currencies into fiat currencies (EUR, CHF, USD) and receive a Visa debit card to access your account balance.

Although the Fiat24 NFT is currently free to acquire, it requires burning one Fiat24 platform token, F24.

The project is built on Ethereum layer 2 Arbitrum. The Arbitrum DAO has given support to the project since the launch of the first Arbinaut-designed Visa debit card and has also granted Fiat24 ARB — Arbitrum’s native token — in the latest LTIPP grant, with an airdrop expected soon.

The integration of Web3 technology into banking represents a significant shift toward more decentralized, efficient and secure financial systems. As more fintech companies adopt blockchain solutions, traditional banking processes are set to evolve, offering greater flexibility and innovation to users worldwide.