Source: CoinDesk

RWAs continue to experience growth led by tokenized U.S. Treasuries.

- RWAs continue to experience growth led by tokenized U.S. Treasuries.

- BlackRock’s boasts a market value of over $500 million.

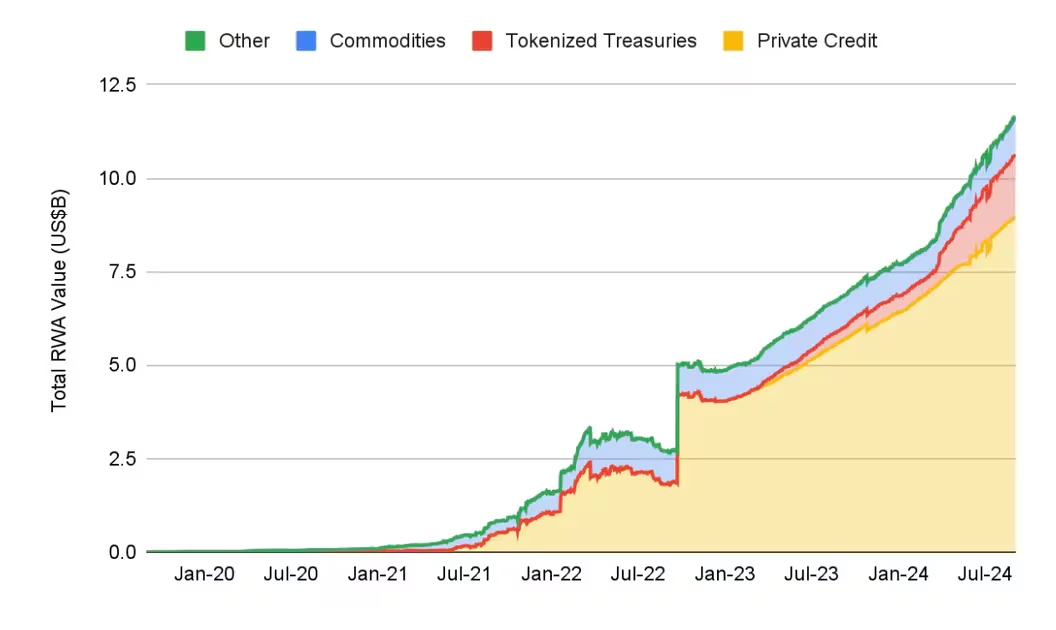

The market value of on-chain real-world assets (RWAs), excluding stablecoins, continues to rise, representing continued investor interest in blockchain-based tokenization of traditional assets.

Currently, total RWAs are worth more than a record $12 billion, according to a report published by Binance Research on Friday. That amount excludes the $175 billion stablecoin market.

Tokenization of RWAs like real estate, government bonds, stocks, and intangible assets like carbon credits makes traditionally illiquid markets easier to trade, allowing investors to purchase assets in fractions while facilitating clear records and streamlining the settlement process.

For over a year, tokenization has been touted as a trillion-dollar opportunity, accelerating traditional finance’s transition to blockchain rails. Bigwigs from Wall Street, like BlackRock (BLK) and Fidelity, have successfully forayed into RWAs alongside several crypto-native projects such as Securitize and Polymath.

Tokenized treasury funds, digital representations of the U.S. Treasury notes, have surpassed $2.2 billion in market value, with BlackRock’s BUILD boasting nearly $520 million. With a market cap of $434 million, Franklin Templeton’s FBOXX is the second-largest tokenized Treasury product.

Elevated interest rates in the U.S. have catalyzed the rapid growth and leadership of the tokenized Treasuries market, according to Binance Research.

“This growth has likely been impacted by U.S. interest rates being at a 23-year high, with the federal funds target rate having been held steady at 5.25%-5.5% since July 2023. This has made the US government-backed yield of Treasuries an attractive investment vehicle for many investors.”

The Federal Reserve, however, is expected to cut rates in the coming months, potentially denting the appeal of yield-bearing instruments, including tokenized Treasuries. The central bank is likely to announced the first rate cut next week.

Per Binance Research, sizeable rate reductions may be needed to weaken the demand for tokenized Treasuries materially.

“With rates so high at the moment, the size and regularity of any cuts will be crucial. As things stand, the major tokenized Treasury products yield between 4.5%-5.5%, thus it will take quite a few cuts before these yields become uncompetitive.”

Binance Research also took stock of on-chain private credit, tokenized commodities and real estate. The report said the on-chain credit market is worth $9 billion or just 0.4% of the traditional private credit market sized at $2.1 trillion in 2023.

Besides, Figure, a fintech company providing lines of credit collateralized by home equity, accounted for most of the market value of the on-chain private credit market. However, excluding Figure, the sub-sector has still experienced growth in terms of active loans, led by Centrifuge, Maple, and Goldfinch.