Source: Be In Crypto

- RWA tokenization market surpasses $10 billion, driven by institutional interest and integration with DeFi.

- BlackRock, Franklin Templeton, and Grayscale lead in tokenized assets, reflecting TradFi’s move into DeFi.

- Ondo Finance emerges as a market leader with $536 million TVL, promoting RWA adoption and liquidity.

The Real World Assets (RWA) tokenization market exceeded $10 billion in valuation, driven by growing institutional interest and a general push to integrate traditional (TradFi) and decentralized finance (DeFi).

Supporters of tokenized real-world assets (RWAs) believe they offer several advantages. They make it easier for investors to diversify their portfolios, trade assets, and access more investment options. Additionally, they provide greater liquidity, simplify asset transfers, and enhance regulatory compliance through smart contracts.

Over $10 Billion of Tokenized RWAs on Public Blockchains

On-chain data from OurNetwork shows that the tokenized RWA market has surpassed $10.9 billion. This represents a rise of more than $2 billion since the beginning of the year, driven by strong demand for private loans and US Treasury debt.

“The private credit market currently stands at $8.1 billion while that of tokenized treasuries is $1.9 billion. The remaining tokenized asset classes fall under $1 billion,” the research highlighted.

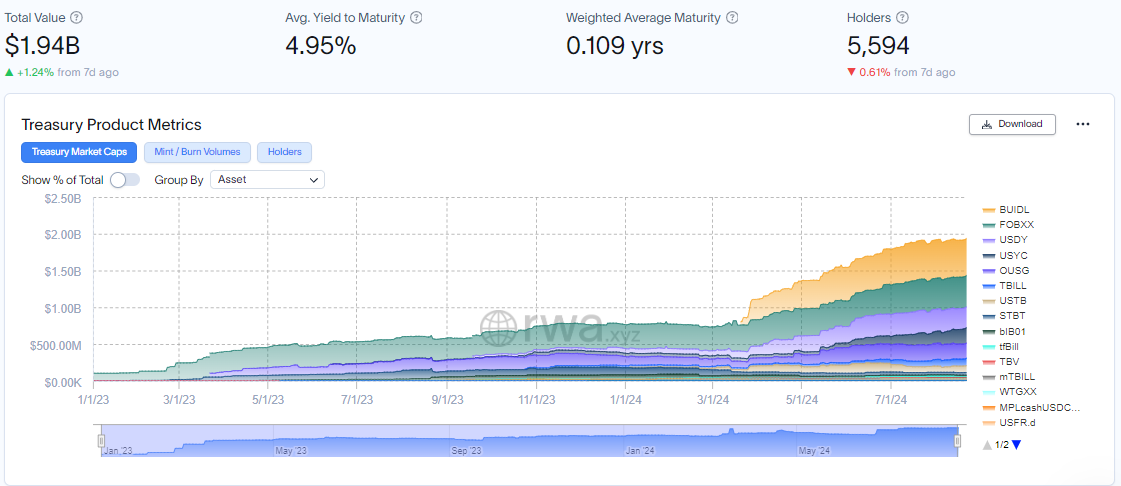

Indeed, the tokenized US Treasury market has experienced substantial growth in 2024. RWA.xyz data shows that this segment’s total value expanded from $726.23 million to $1.94 billion this year.

BlackRock’s BUIDL, a tokenized real-world asset (RWA) fund launched in March, is emerging as a leader in the sector. The fund’s rising dividend yields highlight institutional investors’ increasing interest in tokenized money market funds. DeFi protocols like Ondo are leveraging BUIDL for derivative products, further expanding its use case.

Other significant players in the tokenized RWA space include Franklin Templeton and Grayscale. Franklin Templeton’s Nasdaq-listed Onchain US Government Money Fund (FOBXX) has recently been deployed on Arbitrum and Avalanche. Grayscale, like Franklin Templeton, runs a tokenized RWA fund on Avalanche but also offers a broad portfolio of crypto investment trusts across various tokens.

Institutional interest is broadening, with firms like Goldman Sachs exploring tokenized treasuries. Additionally, State Street has partnered with Swiss crypto firm Taurus to launch a service enabling RWA tokenization. These moves signal a growing push to integrate traditional finance into the decentralized finance ecosystem.

Ondo Drives RWA Tokenization in DeFi

Meanwhile, it’s crucial to highlight Ondo Finance (ONDO) as a leading provider of tokenized U.S. Treasuries. According to data from DefiLlama, the total value locked (TVL) on ONDO exceeds $536 million, representing cash-equivalent products. This positions ONDO as a key player in the growing tokenized finance sector, offering a bridge between traditional assets and decentralized finance.

This growth is driven by Ondo Finance’s focus on boosting adoption, integrations, and liquidity for its tokens. Its yield-bearing stablecoin, USDY, is available across multiple blockchains, including Ethereum, Solana, Cosmos, Aptos, Mantle, and Sui.

The rise of tokenized real-world assets (RWAs) comes at a crucial time, as institutional players increasingly gain exposure to cryptocurrencies. The approval of Bitcoin (BTC) and Ethereum (ETH) ETFs brought these assets to Wall Street, attracting more institutional capital.

Tokenizing RWAs addresses the needs of institutional clients seeking secure banking partners and custody solutions for their crypto holdings. By tokenizing assets, blockchain technology offers a safer alternative compared to less secure exchanges or wallet providers. This process also streamlines operations and opens up new opportunities.

However, the sector faces several challenges before achieving widespread adoption. Issues like establishing token legitimacy, ensuring legal acceptance in courts, and securing smart contracts are hurdles that need to be addressed for tokenized RWAs to go mainstream in traditional and decentralized finance.