Source: The Tokenizer

An interview with Samson Lee, Founder & CEO of Asia-based Coinstreet Partners and Chairman of the organizing committee for the TADS AWARDS (Tokenized Assets Digitized Securities Awards), the world’s first international awards for asset tokenization and digital security space.

Q1. Can you explain what Coinstreet is and why you created it?

Samson (or Sam): Coinstreet was created based on a vision of bringing an equal opportunity for investors worldwide and solving corporate financing inefficiencies for small and medium enterprises. In the conventional financial market, large funds, financial institutions and corporations have many unfair advantages on fundraising and accessing exclusive investment opportunities. What has happened in the fintech and digital asset space will transform this imbalance, and Coinstreet is positioning itself to be the enabler, facilitator and catalyst of this process.

Q2. Can you tell us about your journey into the asset tokenization and digital securities market?

Sam: In the ’90s, the Internet revolutionized the world by re-inventing information, media and telecommunication and media inclusion globally. People could enjoy and benefit from easy access to digital communication, information, media, entertainment, education, social media at their fingertips. Now, another revolution is happening, with momentum at times stronger than the Internet wave. Blockchain will re-invent the financial industry through distributed ledger technologies and bring wealth inclusion to the world through the application of asset tokenization and digital securities. I am very fortunate to have experienced the Internet revolution in the early days of my career and am extremely grateful to be part of the tokenization revolution now.

Q3. What are security tokens and STO’s?

Sam: Asset tokenization refers to using financial assets (i.e. equities, debts, funds), fixed assets (i.e. real estate, infrastructures, machinery) or commodity assets (i.e. precious metals, agricultures) and collectable assets (i.e. arts, wine, antiques) as underlying assets for issuing financial derivatives in the form of digitized securities, based on decentralized ledger technology or blockchain technology. These financial investment products are sometimes also called “Security Tokens.” The initial offering of these Security Tokens for subscription from investors is called Security Token Offering or “STO.”

Q4. How is asset tokenization / digital securities influencing the landscape of the financial market?

Sam: While DLT or blockchain technologies enable and streamline the technical implementation of asset tokenization and security digitization, such technologies also facilitate fractional ownership and bring new liquidity to the new asset class. Also, security tokens can provide high transparency in relation to asset ownership, solve the double-sold problem and minimize counterparty risk during a financial transaction.

The underlying transaction records of security tokens can be easily traced and can eliminate any additional risk resulting in undesired leverage. This new asset class can provide many advantages to the conventional financial market.

Q5. What are the opportunities for enterprises from asset tokenization / digital securities or STO’s?

Sam: An STO is a cost-effective and highly efficient way to conduct a global private placement of investment products for professional/accredited investors, family offices, investment funds and financial institutions. Apart from the initial offering, STO’s also offer the opportunity for the investment products to be traded on licensed secondary digital exchanges in multiple jurisdictions. This brings extra liquidity to financial products and expedites the timeline for reaching liquidity events. For example, for an STO, this could be a matter of months compared to the 7-10 years’ cycle expected for traditional VC funds.

Q6. What advice would you like to give to future STO issuers (companies who are interested in raising funds)?

Sam: Successful STO’s tend to be more investor-oriented. Although tokenization and fundraising are key components in an STO project, as STO issuers, the focus should be on the token, not about how much money they want to raise. We should be thinking about investment opportunities that are being crafted out for potential investors. Profitable investors are the happiest investors, and building a community full of happy investors is one of the key success factors for any STO projects.

Q7. How can Coinstreet help enterprises who are interested in conducting an STO?

Sam: In collaborate with licensed service providers in various countries, Coinstreet provides a range of one-stop, end-to-end STO services, starting from a business plan, white paper, token economics/business modelling, offer/deal structuring, PPM/Prospectus, legal compliance, technical token issuing, smart contract audit, KYC/AML, investor onboarding, global distribution coordination, global private placement, digital custodian, treasury wallet management, exchange listing, post-listing maintenance, investor relations, liquidity management and asset management. We are also very flexible about working with clients on a modular basis to “fill-in-the-gap” and complement their needs.

A New Asset Class for Alternative Investment

Q8. How should investors understand tokenized assets and digitized securities as an asset class?

Sam: Investors shouldn’t be intimidated by technical elements or new terms of this new asset class. It is not about the blockchain or the token. Investors should think of them as financial derivative products and focus on the underlying assets and investment opportunities. In that case, many of the traditional wisdoms of evaluating an investment can be applied. On the other hand, the tokenized layer is also very important because it provides a new liquidity path from global placement and secondary trading.

Q9. What are the actual benefits to the investors and the investment market you see from this asset class?

Sam: STO’s provide an alternative path for investors to source good private investment opportunities globally. Instead of going through the traditional GP/LP fund structure where the funds are locked for 7-10 years, investors can invest in projects through tokenized structures and benefit from liquidity as the asset listing process on STO exchanges is simpler, quicker and easier, compared to listing on traditional stock exchanges.

Q10. What is required to grow more interest from the investment community to facilitate asset tokenization and to make the digital securities market take off?

Sam: I feel that education and regulation are the two most important factors. Education is key as both investors and enterprises need to understand this new asset class and process. Risk management is one of the top considerations for managing wealth. People will only be comfortable in making investments if they understand how things work. Investor protection, on the other hand, is also very important. A clear regulatory framework will not only protect investors, but it can also provide clarity for “rules of game” so that more enterprises can join by structuring digital securities in a fully compliant way for the long term.

GOIR & TADS Awards

Q.11 Coinstreet has been busy during 2020 with two significant initiatives despite COVID19. Can you tell us more about them?

Sam: Of course. Global Online Investor Roadshow, or GOIR, is the next generation, institutional scale, online private placement platform for private equity, alternative investment, and digital asset opportunities. It is the biggest online investor roadshow of its kind, with the deepest reach and broadest coverage. Since its inception, GOIR has helped many investors secure unique investment opportunities and has allowed fund managers to curate investment deals online as usual. GOIR events are highly anticipated and have been held on almost a monthly basis throughout 2020 despite the challenges of COVID-19. GOIR has become the “go-to event” for deal sourcing by professional investors and fundraising from high-quality private companies.

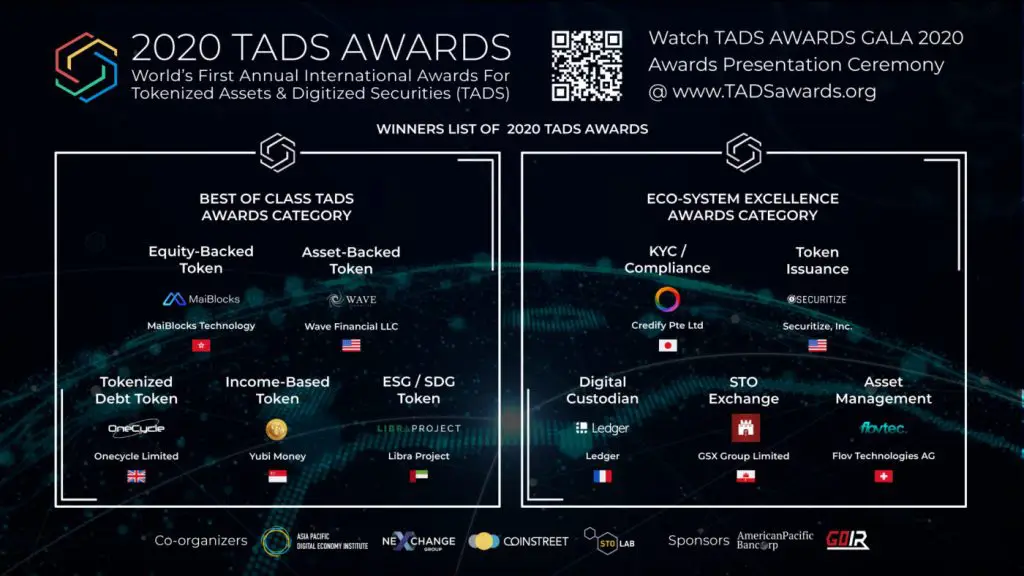

TADS Awards is the world’s first annual international awards for Tokenized Assets & Digital Securities (“TADS”) sector. It celebrates these industries by recognizing and honouring significant contributions and distinguished achievements worldwide. Hosted annually, the TADS Awards brings together individuals and businesses to share the energy that tokenization brings to the financial sector. TADS Awards also aims to nurture these specific industries’ growth by jointly establishing “best practices” and setting “measuring standards” for high-quality tokenized assets and digitized securities, together with other industry leaders on the global market. We were thrilled to complete the first TADS Awards in November, with ten winners for the “BEST OF CLASS TADS” and “ECOSYSTEM EXCELLENCE” awards.

Q12. Can you tell me more about the recent announcement of DSS and GSX for launching the STO exchange in the US market?

Sam: Sure. This JV collaboration forms a unique partnership of three key leaders in their field, combining traditional capital market experience, fintech innovations, and business networks from three continents, North America, Europe, and Asia, to capitalize on unique digital asset opportunities. It will first pursue a digital securities exchange license in the US. Moving forward, this JV will be the key operational company building and operating a digital securities exchange that utilizes the GSX STACS blockchain technology, serving corporate issuers and investors in the sector.

Through the JV collaboration, DSS, Coinstreet Partners, and GSX Group could become the next digital asset exchange to secure FINRA registration as an alternative trading system (ATS).