Source: Medium

Introduction

The financial landscape is undergoing a significant transformation driven by innovations in asset tokenization. Real World Asset (RWA) tokenization has gained considerable attention for its ability to enhance ownership and liquidity of tangible assets. At the same time, a new frontier is emerging: Real World Business (RWB) tokenization. This article explores the trends in both RWA and RWB tokenization, examining their implications for investors and the regulatory environment [5].

Reflecting on my previous article, “The Next Frontier of Financial Market(I) — Asset Tokenization” published five years ago, we noted the transformative potential of asset tokenization in reshaping traditional finance. In this piece, we will delve into the nuances of RWA and RWB tokenization, emphasizing their potential to democratize investment opportunities and enhance market efficiency.

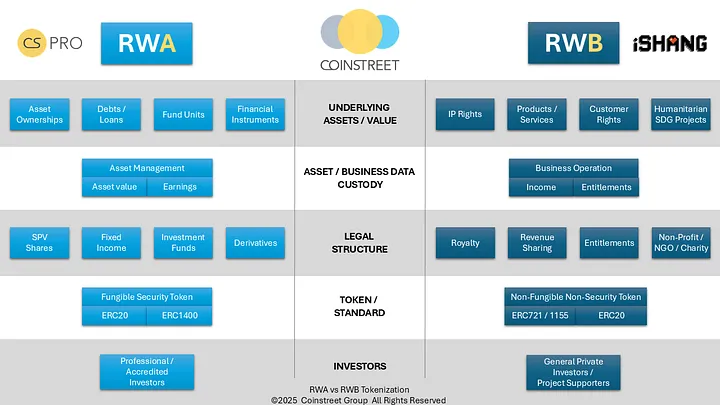

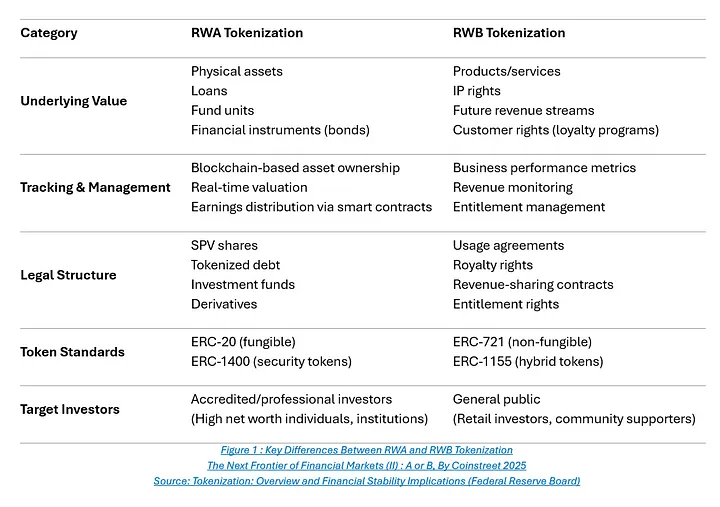

A or B: Key Differences Between RWA & RWB Tokenization

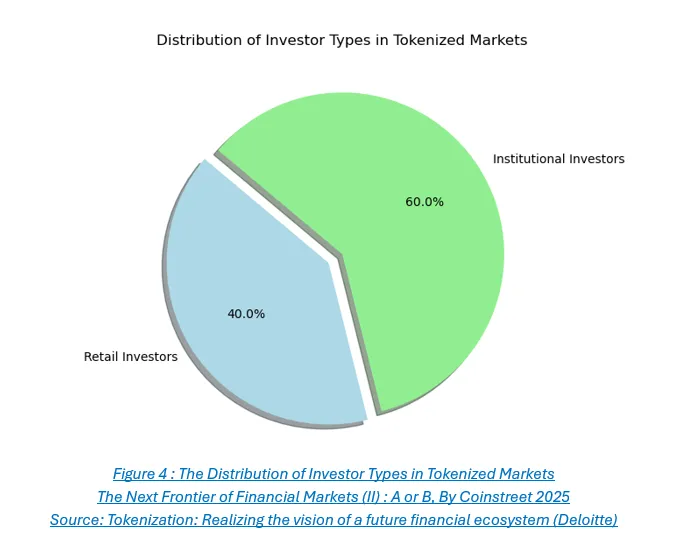

RWA Tokenization focuses on fractional ownership of physical assets such as real estate or commodities. This approach operates under strict securities regulations that ensure investor protections but often limit accessibility for retail investors. RWA tokenization allows for the trading of tokenized shares on secondary markets, providing higher liquidity. For instance, shares of tokenized real estate, like a New York office building, can be easily bought and sold, appealing primarily to institutional investors seeking stable and regulated investment opportunities[9].

RWB Tokenization, in contrast, centers on digitizing the operations of organizations, including business and non-profit activities. For example, a café might tokenize its future revenue, allowing investors to buy tokens representing a share of those income streams. RWB tokenization prioritizes flexibility with lighter regulatory oversight, enabling smaller businesses and non-profit organizations to innovate their funding models. However, this flexibility often comes with constrained liquidity, as RWB tokens may not be as readily tradable as RWA tokens. Additionally, while RWAs cater to institutional investors, RWBs empower smaller enterprises to engage a broader range of investors, albeit with jurisdictional risks due to evolving compliance frameworks.

While there are distinct differences between RWA and RWB tokenization, the two are not mutually exclusive and can coexist. Organizations can deploy and offer both RWA and RWB tokens to achieve an optimal strategy in meeting their corporate goals.

Summary of Differences

Current Market Trends

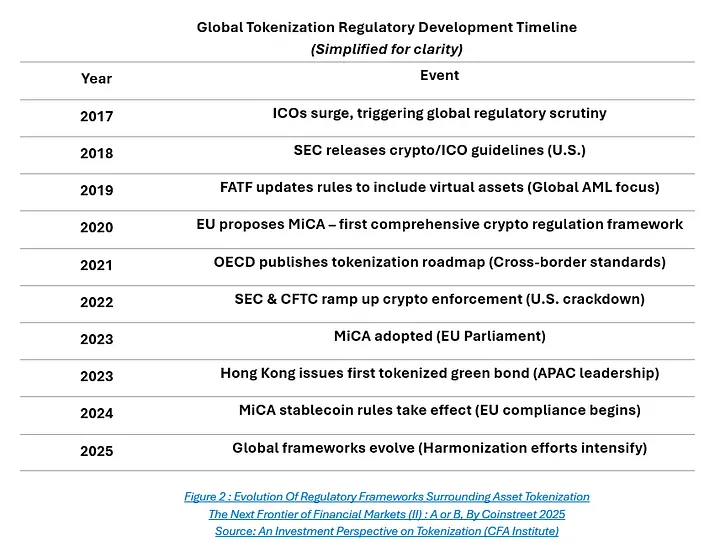

Increased Regulatory Clarity — Regulatory bodies are establishing frameworks for security token offerings (STOs) and digital assets. RWA regulations focus on compliance and investor protections, while RWB presents unique regulatory challenges, offering businesses greater flexibility in capital raising. For example, the European Union’s Markets in Crypto-Assets (MiCA) regulation aims to provide a comprehensive framework for crypto-assets, which may allow for more flexibility in how tokens like RWB are classified and marketed. For more insights, visit the CFA Institute[5].

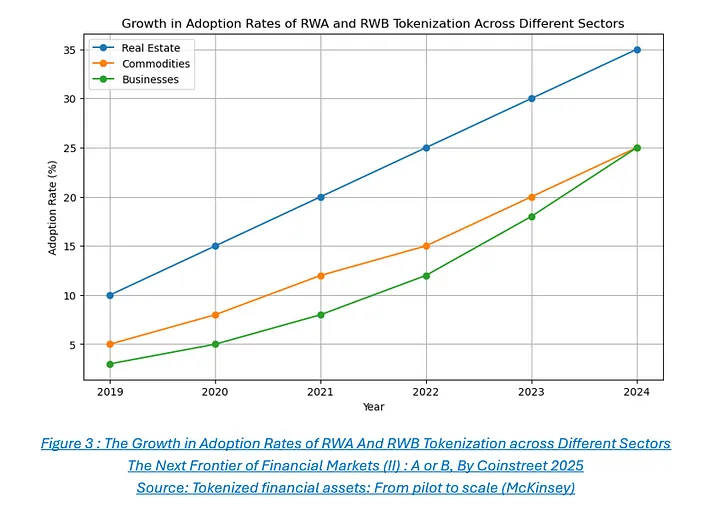

Mainstream Adoption — Both RWA and RWB tokenization are gaining traction among businesses and investors. Financial institutions are exploring tokenized real estate and commodities, while startups are leading RWB tokenization to facilitate capital raising and business growth. According to a report by McKinsey[4], the adoption rates of tokenization are steadily increasing across various sectors, indicating a growing acceptance of these innovative financial instruments. offers further analysis on adoption rates.

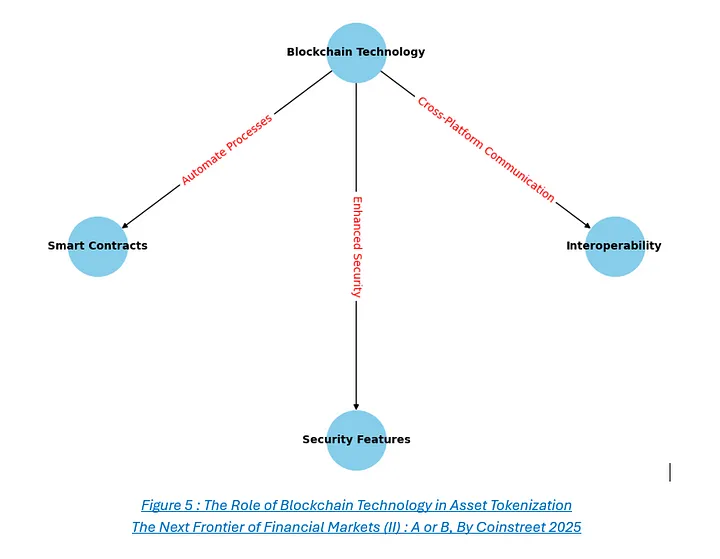

Technological Advancements — Blockchain technology drives innovation in asset tokenization. Key advancements include:

- Interoperability: The ability for different blockchain networks to communicate enhances the trading of both RWAs and RWBs across platforms, promoting liquidity and efficiency [9].

- Smart Contracts: These self-executing contracts automate processes and enforce agreements, reducing the need for intermediaries. This technology is particularly advantageous for RWBs, where complex business agreements can be streamlined [9].

Understanding RWA & RWB Tokenization

Real World Asset (RWA) Tokenization

RWA tokenization [7] involves converting physical assets (like real estate, commodities, and art) into digital tokens on a blockchain. This allows for fractional ownership, enhanced liquidity, and easier transfer of assets. These tokens represent ownership stakes, enabling fractional ownership and improving liquidity. RWA tokens are classified as securities, necessitating compliance with stringent regulations and targeting professional or accredited investors.

Definition and Scope

- Definition: RWA tokenization involves creating a digital representation of a tangible asset on a blockchain, enabling secure and transparent transactions.

- Scope: This includes various asset classes such as real estate, precious metals, art, and collectibles. The tokenized assets can be traded on secondary markets, increasing accessibility for investors.

Benefits of RWA Tokenization

- Liquidity: Tokenization allows fractional ownership, making it easier to buy and sell portions of high-value assets.

- Transparency: Blockchain technology provides a transparent record of ownership and transactions, reducing fraud.

- Accessibility: Broader access for investors who may not afford whole assets, democratizing investment opportunities.

- Efficiency: Streamlined processes reduce the need for intermediaries, lowering transaction costs and speeding up sales.

Use Cases

- Real Estate: Platforms like Real Estate Investment Trusts (REITs) use tokenization to allow investors to buy shares in properties.

- Art: Companies like Myco enable fractional ownership of artwork, allowing multiple investors to own a piece of a valuable painting.

- Commodities: Tokenizing gold or silver allows for easier trading and ownership verification.

Real World Business (RWB) Tokenization: A New Paradigm

In contrast, RWB tokenization digitizes business operations, product sales, revenue streams, commercial contracts, IP rights, and customer entitlements without classifying these tokens as securities[7]. This flexibility allows businesses to creatively raise capital and engage a broader range of investors, circumventing traditional regulatory constraints and appealing to general private investors. RWB tokenization introduces a transformative approach to the financial ecosystem. Unlike RWAs, RWB tokenization introduces a transformative approach to the financial ecosystem, enabling capital raising without the complexities typically associated with regulatory compliance. Instead of purchasing shares in a company, investors can “buy into” specific revenue streams or anticipated value growth — such as a portion of a startup’s future sales or royalties from a successful song — emphasizing earnings from the venture’s success rather than mere ownership.

Definition & Scope: PROFIT PARTICIPATION, NOT OWNERSHIP

- Definition: RWB tokenization creates digital tokens that represent ownership or rights related to a business, facilitating transactions and investments.

- Scope: This includes revenue rights, customer loyalty programs, intellectual property, and other business-related assets.

- Definition & Scope: RWB tokenization digitizes business assets, operations, or revenue streams, including future revenue, customer contracts, or equity stakes, enabling innovative investor engagement [8].

Benefits to Businesses

- Enhanced Liquidity & Access to Capital: Access capital by selling divided ownership in revenue streams or IP rights, raising funds from a broader pool of investors.

- Customer Engagement: Tokenizing customer rights boosts loyalty and interaction opportunities, fostering a community of stakeholders invested in the company’s success.

- Revenue Opportunities & Innovation: Monetize assets effectively with tokenized offerings, creating diverse revenue streams and encouraging new business models and investment strategies.

- Flexibility: Structure RWB tokens to meet specific needs, allowing unique investment opportunities without stringent regulatory constraints.

- No Equity Dilution: Founders retain ownership while tokenizing a portion of revenue, such as 10% of software subscription revenue.

- Royalties 2.0: Tokenize IP rights, enabling creators to earn micro-royalties from their work.

- Hyper-Targeted Investing: Allow investors to back specific projects instead of the entire company, such as a solar farm tokenizing future energy sales.

Benefits to Investors

- Niche Opportunities: Invest in diverse assets with measurable value, such as future harvests, royalties, or specific revenue streams[5].

- Divided Ownership: Gain access to investments that were previously reserved for institutional investors, allowing for lower entry points.

- Direct Revenue Participation: Engage directly with revenue-generating projects, increasing transparency and alignment with business success.

- Predictable Payouts: Tokens tied to revenue provide returns similar to mini-bonds, offering reliable income based on performance.

- Flexible Investment Structures: Participate in unique projects tailored to specific interests or risk profiles, enhancing individual investment strategies.

- No Boardroom Drama: Investors benefit without the complexities of corporate governance; returns depend solely on the business’s success.

Use Cases

- IP Rights: Companies like Myco enable creators to tokenize and monetize their intellectual property through direct investments.

- Revenue Streams & Sharing: Platforms like CurioInvest allow investors to buy shares in luxury assets, sharing in revenue generated from appreciation and future profits without owning equity.

- Customer Rights: Companies like Uphold tokenize customer loyalty points, enabling customers to trade or use these tokens across platforms.

- Contract Tokenization: Firms can tokenize customer contracts, providing investors with cash flow rights based on performance metrics.

Case Study:

- Tokenizing Products & Services

- Case Study: Supply Chain Transparency

- Company: VeChain

- Overview: VeChain uses blockchain to tokenize products in supply chains, enabling real-time tracking of goods. Each product is linked to a digital twin on the blockchain.

- Impact: This enhances transparency and trust, allowing consumers to verify the authenticity and origin of products, leading to increased sales and customer loyalty.

- Tokenizing Intellectual Property Rights

- Case Study: IP Rights

- Company: Myco

- Overview: Myco allows creators to tokenize their intellectual property (IP) rights, giving them a stake in the revenue generated from their work.

- Impact: This model empowers artists and innovators by providing a new revenue stream and ensuring they receive royalties directly through smart contracts.

- Tokenizing Sales & Revenue

- Case Study: Divided Ownership

- Company: CurioInvest

- Overview: CurioInvest tokenizes luxury cars, allowing investors to purchase shares in high-value assets. Each token represents a divided ownership of a vehicle.

- Impact: This democratizes investment in luxury assets, enabling broader participation in wealth creation from high-end markets and increasing liquidity for asset owners.

- Case Study: Revenue

- Company: The Indie Film Revolution

- Overview: An indie filmmaker seeks $2 million to produce a documentary. Traditional equity investors require creative control and a significant share of profits.

- Impact: By tokenizing 154,000 tokens, the filmmaker raises the necessary funds while retaining full ownership. If the film flops, investors lose their investment like traditional equity. However, if it succeeds, token holders receive 15% of revenue from deals with platforms like Netflix or Hulu, allowing the filmmaker to maintain 100% ownership.

- Tokenizing Customer Rights

- Case Study: Customer Rights

- Company: Uphold

- Overview: Uphold has developed a platform that allows users to tokenize their rights as customers, including loyalty and rewards points.

- Impact: Customers can trade or use these tokens across different platforms, enhancing customer engagement and providing businesses with valuable insights into consumer behavior.

Regulatory Considerations

RWA tokenization, on the other hand, complies with existing securities laws, providing a clear legal framework that boosts investor confidence and legitimacy. This compliance can be complex and costly, potentially limiting flexibility and innovation. Navigating these regulations requires careful consideration to ensure both compliance and the ability to innovate.

RWB tokens, on the other hand, navigate securities laws by focusing on utility rather than being classified as securities, which allows broader participation from general private investors. This approach can enhance accessibility and legitimacy as regulations evolve. The SEC’s Howey Test, which assesses the expectation of profits from others’ efforts, is a key factor in determining whether a token is considered a security. If RWB tokens are structured as pure revenue-sharing contracts (e.g., “You get 0.1% of our Q3 sales, period”), they might avoid the “security” label.

RWB’s magic lies in avoiding securities laws… for now. The SEC cares about expectation of profits from others’ efforts (the Howey Test). But if tokens are structured as pure revenue-sharing contracts (e.g., “You get 0.1% of our Q3 sales, period”), they might dodge the “security” label[2].

However, there are risks associated with RWB tokenization that cannot be ignored. Transparency issues arise when verifying a company’s reported revenue, although smart contracts linked to bank accounts could automate payouts. Unlike stocks, RWB tokens rarely offer voting rights or bankruptcy claims, meaning investors are last in line if the business fails. Additionally, the speculative nature of RWB tokens can lead to volatility, requiring guardrails to prevent misuse, similar to the tokenization of memes.

Risks You Can’t Ignore

- Transparency Issues: How do you verify a company’s reported revenue? Smart contracts linked to bank accounts could automate payouts.

- No Safety Net: Unlike stocks, RWB tokens rarely offer voting rights or bankruptcy claims. If the business fails, you’re last in line.

- Speculative Fever: Remember when people tokenized memes? RWB needs guardrails to avoid becoming a casino.

Global Regulatory Landscape

The regulatory landscape surrounding tokenization is evolving rapidly. Different jurisdictions are adopting varying approaches to regulate tokenized assets:

- United States: The SEC has expressed its intent to apply existing securities laws to tokenized assets, creating uncertainty for industry participants. The lack of comprehensive legislation has left the usage of tokenized assets in legal limbo, hindering the development and adoption of RWA tokenization in the U.S. SEC Guidelines on Token Offerings[2].

- European Union: The EU is working on comprehensive regulations for digital assets, aiming to create a harmonized framework that balances innovation with investor protection. MiCA is a significant step towards establishing a clear legal framework for asset tokenization in Europe MiCA Overview[3].

- Singapore: The Monetary Authority of Singapore (MAS) has issued guidelines for security token offerings and established a sandbox environment for testing new tokenization projects, fostering a supportive regulatory environment MAS Guidelines.

Investment Liquidity & Accessibility

The evolution of asset tokenization, particularly through RWAs and RWB tokenization, is poised to reshape the financial landscape. RWB tokenization offers a flexible and accessible means for businesses to engage with investors and raise capital, significantly enhancing liquidity for traditionally illiquid assets. By enabling divided ownership and innovative investment structures, tokenization democratizes access to business investments, fostering entrepreneurship and innovation across sectors[5].

Conclusion

The evolution of asset tokenization, through both Real World Assets (RWAs) and Real World Business (RWB) tokenization, is poised to significantly transform the financial landscape. As regulatory frameworks develop alongside technological advancements, the potential for innovation and growth in this area is substantial.

RWB tokenization provides a flexible and accessible means for businesses to engage with a broader range of investors, enhancing capital accessibility and facilitating divided ownership of traditionally illiquid assets. This democratization of access allows smaller enterprises to attract funding without the complexities of traditional equity offerings, spurring entrepreneurship and driving innovation across various sectors. By enabling divided ownership and innovative investment structures, RWB tokenization allows a diverse array of investors to participate in markets previously exclusive to institutional players, fostering a more inclusive financial ecosystem.

RWA tokenization, on the other hand, offers a structured and compliant framework for high-value asset investments. It enhances liquidity for traditionally illiquid assets, allowing divided ownership and democratizing access to these investments. However, navigating the regulatory complexities can be costly and restrictive, potentially limiting flexibility and innovation.

To fully realize the benefits of asset tokenization, stakeholders — including financial institutions, regulators, and technology providers — must collaborate to create an ecosystem that supports the growth of both RWAs and RWBs while ensuring investor protection. The era of “investing without owning” is here, fundamentally reshaping the rules of who gets paid, how, and why.

RWB tokenization is not merely replacing traditional financial systems; it is creating a parallel universe where value flows differently. For artists, small and medium-sized enterprises (SMEs), and innovators, it presents a game-changing opportunity. For investors, it offers high-risk, high-reward scenarios that require careful consideration. By embracing collaboration and innovation, we can unlock the transformative potential of asset tokenization, paving the way for a more inclusive and dynamic financial future.

While there are distinct differences between RWA and RWB tokenization, the two are not mutually exclusive and can coexist. Organizations can deploy and offer both RWA and RWB tokens to achieve an optimal strategy in meeting their corporate goals.

About Coinstreet Group

Coinstreet Group is a leading decentralized investment banking and consultancy firm specializing in finance, media, and technology sectors. With a commitment to fostering innovation in the digital economy, Coinstreet provides a comprehensive ecosystem for high-quality token projects. The firm collaborates with regulated market operators and licensed broker-dealers from major financial markets worldwide. Coinstreet is dedicated to enhancing financial inclusion and democratizing access to investment opportunities. For more information, visit Coinstreet Group (www.coinstreet.group).

Appendix: Research on RWB Tokenization and Compliance: Legal Standpoints for General Private Investors (DISCLAIMER — WE ARE NOT LAWYER, AND THIS IS NOT LEGAL ADVICE BUT OUR SUBJECTIVE POINT OF VIEWS BASED ON OUR RESEARCH WHICH HAS NOT BEEN PROVEN AND VERIFIED BY LEGAL PROFESSIONAL)

The tokenization of real-world assets (RWAs) has gained significant traction, particularly with the rise of decentralized finance (DeFi). However, the classification of these tokens, especially regarding compliance with securities laws, remains a critical issue. This discussion focuses on the RWB token and its potential to be marketed to general private investors rather than being restricted to accredited investors.

Understanding RWB Tokenization

RWB tokens represent a digital claim rights on real-world business operations. The process of tokenization allows these businesses to be divided, making them more accessible to a broader range of investors. This democratization of investment opportunities is one of the key benefits of tokenization, as it lowers the barriers to entry for retail investors [1].

Compliance & Legal Standpoints

- Classification as a Security: The primary legal concern surrounding tokenized assets is whether they are classified as securities under existing regulations. In the U.S., the Securities and Exchange Commission (SEC) has indicated that many tokens, particularly those that offer returns or appreciation, may be treated as securities [2]. However, the RWB token can be structured in a way that emphasizes its utility and functionality rather than its investment potential, potentially allowing it to avoid classification as a security.

- Regulatory Framework: Different jurisdictions have varying approaches to the regulation of digital assets. For instance, the European Union’s Markets in Crypto-Assets (MiCA) regulation aims to provide a comprehensive framework for crypto-assets, which may allow for more flexibility in how tokens like RWB are classified and marketed [1]. In regions where the regulatory environment is more favorable, RWB tokens could be marketed to general private investors without the stringent requirements imposed on securities.

- Investor Classification: The ability to target general private investors rather than just accredited investors hinges on the token’s structure and the regulatory framework in place. If RWB tokens are designed to provide utility (e.g., access to services or products) rather than solely investment returns, they may qualify as utility tokens rather than securities. This distinction is crucial as it opens the door for broader participation from non-accredited investors [2].

- International Perspectives: Many countries are moving towards more inclusive regulations that allow for broader access to tokenized assets. For example, jurisdictions like Singapore have established guidelines that facilitate the issuance of security tokens while also considering the needs of retail investors [2]. This trend suggests that RWB tokens could be positioned similarly in various markets, allowing for wider distribution.

- Compliance Checklist: Issuers of RWB tokens should adhere to a comprehensive compliance checklist to ensure they meet regulatory requirements. This includes conducting due diligence on the issuer, evaluating the legal structure, assessing the eligibility of the underlying assets, and ensuring proper investor verification processes are in place [5]. By following these steps, issuers can mitigate legal risks and enhance the legitimacy of their offerings.

Additional References

- World Economic Forum — How tokenization is transforming global finance and investment

- SEC — Offerings and Registrations of Securities in the Crypto Asset Markets

- European Commission — Regulation on Markets in Crypto-assets (MiCA)

- McKinsey — From ripples to waves: The transformational power of tokenizing assets

- CFA Institute — An Investment Perspective on Tokenization

- Deloitte Report on Future Financial Ecosystem

- Coindesk — Tokenization: Real World Assets, Real World Benefits

- Forbes — The Future Of Finance Is Tokenized And Fully Regulated

- ChainLink — Real-World Assets (RWAs) Explained

Learn More

- A New Financial Frontier: Tokenization of Real-World Assets (RWA) | by Shogun Saski | Medium

- The Tokenization of RWAs: How Traditional Finance is Being Reshaped — Affidaty Blog

- Tokenization’s Next Frontier: From Proof-of-Concept to Real World Adoption

- Real-World Assets (RWA) Tokenization Insights on April 13, 2024 in Tokyo — Coinstreet Group

- Panel Discussion on: Business Opportunities for Real World Asset Tokenization — Coinstreet Group

- Research Collection — Tokenization of RWA: The Next Fortune Machine or Not? | by HTX Research | Medium

- Understanding the tokenisation of assets in financial markets:

- Tokenization: Realizing the vision of a future financial ecosystem:

- Tokenization: Overview and Financial Stability Implications:

- An Investment Perspective on Tokenization:

- Tokenized financial assets: From pilot to scale: